Seamlessly rollover your old 401(k)s for free and fast!

- Reposition Your Old 401(k)s, 403(b)s, 457...

- Discover your 401(k)s hidden fees

- Hassle-free rollover

- Unlock your old 401(k)/rollover

- 10% Premium Bonus

- 10% Free withdrawal annually, after year 1

...and more!

Smart Choice

Why rolling your old 401(K) can be a smart choice.

2008 Mortgage Meltdown

$2.3 trillion lost in retirement plans

2018 Bond market spike and inflation fear

$5 trillion in market losses

2020 COVID pandemic

$6 trillion in market losses

Employees From

Trusted By Employees From

equity investment

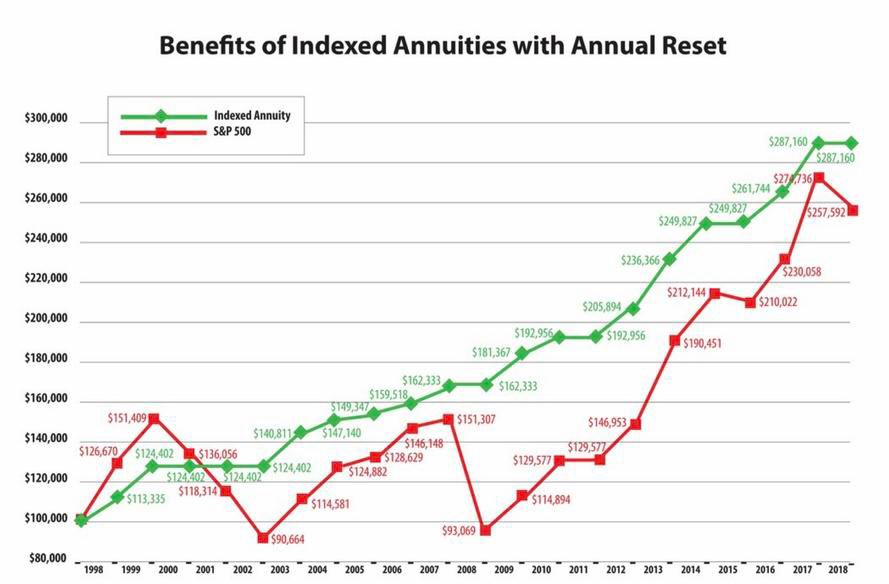

Never lose a penny.

That means that you can grow your retirement savings when markets do well — and never lose a penny interest earned and premium paid when markets fall.”

WHAT WE DO

Ensure Your

Income Lasts a Lifetime

Reclaim Precious Hours of Your Life!

Experience seamless repositioning with our advanced technology and expert team, adept at uncovering forgotten 401(k)s and skillfully managing your rollovers.

Effortlessly Explore Top-Tier Rollover Choices.

Experience unparalleled simplicity at Rollover Boost, the exclusive hub for effortlessly comparing and selecting the optimal rollover tailored to your priorities.

Crafting Support in Your Orbit

Drawing upon extensive expertise in skillfully navigating various financial transitions akin to your own, our team assures a seamless journey through the process.

retirement funds

You aim to maximize the potential of your retirement funds.

Market Risks

Secure Growth: Shielded from Market Risks!

- Maximized Retirement

- Growth Potential

Power of Times

Unlock the Power of Time: Your Key to Retirement Success!

happy customers

Join the countless happy rollover customers

DISCLAIMER

Client testimonials are more private and names of testimonials are not the real names of our customers as we protect our customers personal information. We believe that customers finances along with rollovers are personal and should be kept private.

DISCLAIMER

Client testimonials are more private and names of testimonials are not the real names of our customers as we protect our customers personal information. We believe that customers finances along with rollovers are personal and should be kept private.

DISCLAIMER

Client testimonials are more private and names of testimonials are not the real names of our customers as we protect our customers personal information. We believe that customers finances along with rollovers are personal and should be kept private.

FAQs

Frequently ask questions

A rollover is initiated when you take out funds or assets from one eligible retirement plan and, within a span of 60 days, deposit either the full amount or a portion of it into another qualifying retirement plan.

Is it feasible to transfer my retirement savings, including my 401(k), IRA, or 403(b) accounts, into an annuity without incurring taxes? A. You can execute a tax-free rollover of your IRA, 401(k), 403(b), or lump sum pension payment into an annuity.